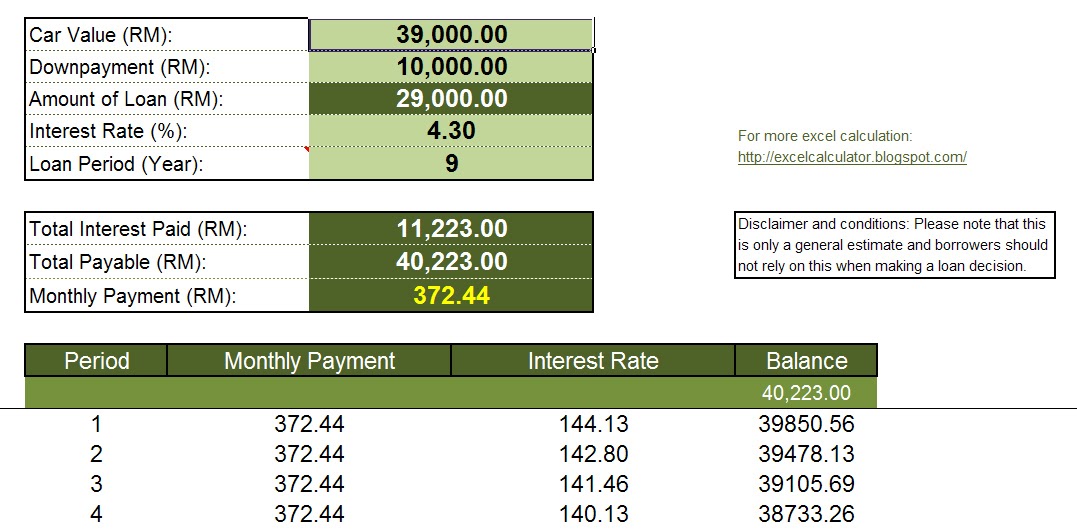

This is over and above the principal that you will repay to the lender for borrowing the funds. Total Interest : This will show the total amount of interest over the life of the loan.Principal Loan Amount : As mentioned above, the principal loan amount will be the difference between the vehicle price of the car and the down payment you provided.Based on the inputs you filled in on the left of the screen, our calculator will provide you with relevant outputs on the right. Once you have entered all the numbers, the last (and most important!) step is to understand what they mean to you as a borrower. Understanding the results of the car loan calculator However, it should be noted that lower down payments up front lead to a higher monthly repayment amount. While 20% is a good minimum to put down, you may be able to obtain loans from lenders that require even lower down payments. The last step is to enter the down payment that you plan to make next to where it says “Down Payment”.For example, 36 months is 3 years, 42 months is 3.5 years, and so on. If you have been offered the loan term in total months, divide the number by 12 to get the loan term in years. Input the loan term that the lender has offered you in the cell next to “Loan Duration”.Make sure that this is quoted on an annual basis to receive the most accurate result Next, enter the interest rate that the lender has quoted you in the cell next to where it says “Interest Rate”.This number should match the total sale price of the car quoted to you minus any discounts or trade-in credits. The first step is to enter the market price of the car that you are planning to buy in the cell next to where it says “Vehicle Price”.Here is a step-by-step list of what you need to do: All the fields that you need to enter are clearly labelled, so you can directly plug and play the numbers from the lender. The calculator then takes over from there. As a user, all you have to do is input the numbers that you have been quoted from your lender into the right box. Our auto loan calculator is designed to be user-friendly. Additionally, used cars are typically financed by buyers who have a lower credit score and who are in a relatively riskier financial position.How to use the Hardbacon Car Loan Calculator This is because the risk for a breakdown is higher for used cars, which in turn affects its resale value and pay off. It is important to note that financing for used cars carries a higher risk for the lender compared to financing new cars.

Why is the interest rate for used car loans higher than the rates for new car loans? No, you are not obligated to anything and are not entering a binding contract by filling out a form and by getting pre-approved by us. Do I enter a contract by completing my car finance application? Overall, your application should typically be approved within a day. Alternatively, you are welcome to call us or leave your phone number and we will walk through the steps over the phone.

The process is very simple and straightforward, with an additional required step to follow if your credit score is bad. we will then brainstorm the best solution for your needs and contact you to complete the application. Simply go to our website and fill out the application form. What do you need to approve my car financing application? Your credit score will not prevent you from receiving financing. At Car-Finance, our mission statement is to help clients with a bad credit score as well. Frequently Asked Questions Is loan approval determined by my credit score?Ĭredit score is one of the factors for approving financing but other considerations are taken into account as well, such as your income, job, assets and possible costs.

0 kommentar(er)

0 kommentar(er)